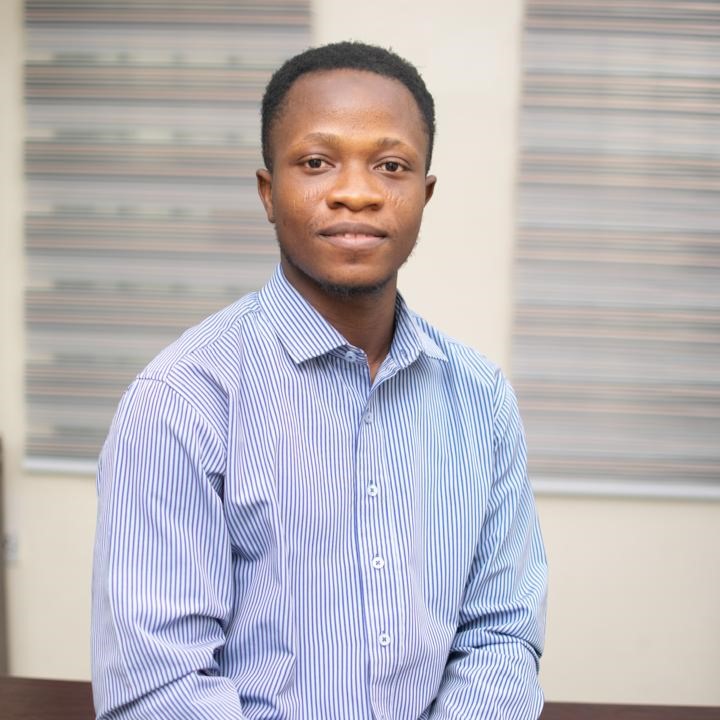

Renowned investor and philanthropist, Tony Elumelu has warned that poverty, no matter where it exists, remains a threat to all of humanity.

Speaking at the 32nd anniversary of the African Export-Import Bank (Afreximbank), held at the 5,000-capacity Transcorp Event Centre in Abuja, Mr Elumelu, the group chairman of United Bank for Africa (UBA) called on financial institutions to channel more investments into African entrepreneurs, describing this as the most sustainable pathway to eradicate poverty and transform the continent.

He noted that with targeted capital deployment, strategic institutional collaborations, and youth empowerment, Africa’s development narrative can be completely redefined.

Addressing an audience on the theme ‘Decades of Delivering on a Shared Aspiration: The Transformational Collaboration between Afreximbank and African Multinational Corporations and Banks’, Mr Elumelu stressed that true development means no one is excluded from the economic mainstream. He added that development banks such as Afreximbank must be empowered to support African entrepreneurs.

Through the Tony Elumelu Foundation, over 24,000 young entrepreneurs across Africa’s 54 countries have been directly empowered, creating more than 400,000 jobs.

“We must not climb and take the ladder away. We must deliberately and consistently create access and open doors so that the next generation can thrive,” he said, emphasising that tackling poverty should be a collective priority for Africa to secure a stable and prosperous future.

Transformative partnership

At the event, Mr Elumelu, who is the Group Chairman of Transnational Corporation (Transcorp), recounted how he left the banking industry to embark on a journey of transforming Africa.

He shared how his ambition to diversify into the energy sector through Heirs Energies in 2010 was nearly stalled due to capital constraints, until Afreximbank and the Africa Finance Corporation (AFC) intervened.

“I was a banker before, and in 2010, I moved on and decided to diversify and do what my friends had been doing, trying to empower Africa and transform the continent. One of the sectors we decided to invest in was the energy sector.

“We approached Shell for a bilateral conversation to acquire some of their assets in Nigeria. We started discussions in 2017, and Shell eventually agreed, but they required us to show evidence of capacity because they receive many enquiries from different people. The assets we identified were OML11 and OML17, and the sum agreed with Shell was $2.5 billion. We needed to show proof of funds before proceeding. We tried with our resources but had a shortfall of $750 million, so we required debt financing for 30 per cent of the transaction.”

Afreximbank intervention and impact

Mr Elumelu recalled a transformative intervention where Afreximbank stepped in with $600 million to support the acquisition of the Shell asset, alongside $150 million from the Africa Finance Corporation (AFC).

According to him, these bold steps taken by the financial institutions made all the difference and have transformed not just his life but the African continent at large.

“What is very impressive about it is the speed and how it was done. Because of this, we were able to complete the transaction. Today, without Afreximbank’s involvement, we would not have been able to do the transaction.

“This acquisition we made with the support of Afreximbank has gone on to become extremely transformative, not just for all the investors but for the continent,” Mr Elumelu added.

Highlighting the long-term impacts of these financial interventions, he stated that Heirs Energies has been recognised as a major player in Nigeria’s energy sector, producing 58,000 barrels of oil daily.

“Today, we produce over 58,000 barrels of oil a day. In fact, NNPC just wrote to the company, acknowledging that we recorded the highest production increase in Nigeria’s oil sector, both among local and international oil companies, in the past five years. This would not have been possible without Afreximbank’s support,” he said.

Path forward

According to Mr Elumelu, Africa cannot compete in the global digital economy without first addressing its basic development challenges.

He warned that the lack of commitment to facilitating economic growth through deliberate investments would continue to hold the continent back. “That is Afreximbank and the private sector working together to create employment for our people, working together to industrialise and transform Africa.

“While the world is racing towards AI and the Fourth Industrial Revolution, we are still held back by the basics: electricity, broadband access, and digital infrastructure. We must fix these foundational issues if we are serious about development,” he said, adding that Africapitalism is also about investing in critical sectors such as power.

Call to action

The philantropist maintained that capital alone does not guarantee success without the dedication and discipline of entrepreneurs.

He encouraged entrepreneurs to be responsible, uphold integrity, and demonstrate excellence when financial institutions make commitments to them.

“When financial institutions give you the opportunity, you must execute with excellence, discipline, and integrity. You must honour your obligations – repay loans, execute with discipline, and deliver results not just for shareholders, but for the community,” he said.

“Only Africans will build Africa,” he stated, reiterating the need for Africans to take the lead in facilitating sustainable development through collaboration, committed entrepreneurship, and visionary leadership.

Commending Professor Benedict Oramah, Chairman of Afreximbank, Mr Elumelu said, “He has shown that African-led institutions can deliver global impact, and his legacy will continue to inspire.”